How To Manage Your Money (Income, Expense, Budget)

Over the past few years, I've experimented with various methods to handle my finances.

I've delved into this because mastering money management is among the most crucial life skills today.

Whether one earns $50,000 or $100,000 annually, the pivotal factor is how effectively they handle their finances.

True money management skill lies in optimizing the use of one's funds, not just for investment and wealth accumulation, but also for striking the right balance between present enjoyment and future planning.

When you find a method that's both simple to execute and maintain, managing finances ceases to feel like a burden.

In this article, I'll walk you through my 3 step approach to efficiently managing your money, empowering you to feel completely in charge of your income and expenditures each month.

Along the way, I'll share some of my top tips.

If you'd like to utilize the same template I've developed, you can click here for a free download.

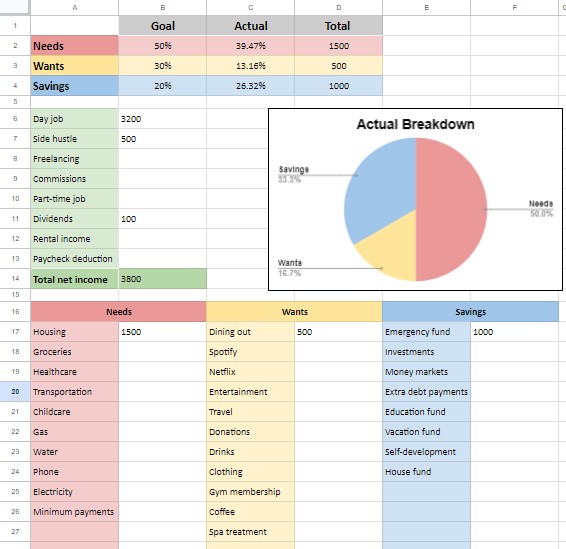

So, let's take a look at the tracker.

It features color-coded spending categories and an overview table at the top.

As you fill in the sheet, you'll notice the cells at "column C" on the overview table at the top changing color.

Additionally, there's a green net income section.

To use it for yourself, simply click "file," make a copy, and you're ready to duplicate and customize it according to your own financial needs.

Net Income Section

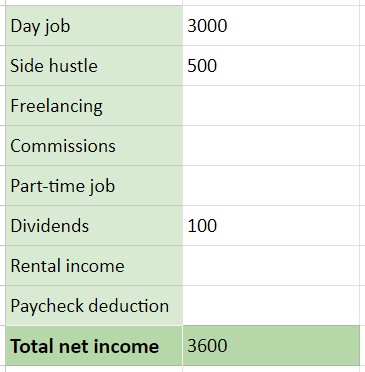

Now, let's dive into step one: defining the three spending buckets.

A crucial aspect of financial control is determining your destination.

But before we get there, it's essential to first ascertain your exact monthly income.

This includes all sources of income, such as your:

- 9 to 5 day job,

- weekend side hustle,

- freelance work,

- commissions,

- part-time job,

- and any investment returns.

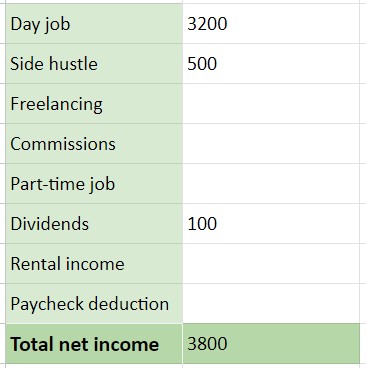

These figures should be entered into the green net income section.

For example, if my monthly take-home pay from my day job is $3,000 after taxes, I'll input that amount.

Let's say I also earn an additional $500 monthly from my side hustle and receive $100 per month in dividends.

These figures would be plugged in accordingly.

If you're employed, determining your income is straightforward—it's the amount that hits your bank account monthly after taxes and other deductions.

In this case, it's $3,000.

However, if you contribute to a workplace pension, it's essential to add that contribution back into your income calculation.

For instance, if you contribute $200 monthly to your pension, your total income would be $3,200.

This adjustment is necessary because the portion contributed to your pension falls under the "Savings" category, which we'll discuss shortly.

For self-employed individuals or freelancers, taxes must be factored in.

It's crucial not to overestimate your income, as this can lead to disappointment when setting and striving for financial goals.

For instance, the $500 from my side hustle is after-tax income.

Once all these figures are inputted, your total income is calculated.

The 3 Spending Categories

Now that we've determined our income, let's move on to defining the three spending categories:

- the 'needs' bucket,

- the 'wants' bucket,

- the 'savings' bucket.

You'll need to decide how much of your net income—$3,800 in this case—you want to allocate to each of these categories.

The funds allocated to the 'needs' bucket cover your essential expenses—things like housing, transportation, and food—basically, the non-negotiables of life.

Money allocated to the 'wants' bucket covers costs that bring joy and enrich your life with experiences.

Lastly, everything you put into the 'savings' bucket is an investment toward the life you envision for yourself in the future.

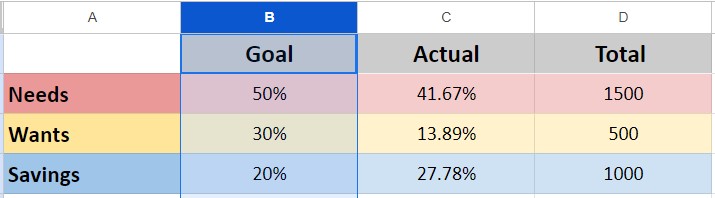

In the world of budgeting, there's a popular guideline known as the 50/30/20 rule, which suggests that 50% of your net income should go toward needs, 30% toward wants, and 20% toward savings.

I've discussed this rule in detail in a video titled "The Easiest Rule To Manage Your Money," so feel free to check it out.

These percentages will be reflected in this column here—50% toward needs, 30% toward wants, and 20% toward savings.

As we fill in the sheet with your actual spending, you'll notice that the colors of these cells will change based on whether you're aligning with your spending goals, overspending, or under-saving.

I want to make a quick point about the 50/30/20 guideline.

It was introduced in 2005 in the book "All Your Worth: The Ultimate Lifetime Money Plan," during a different economic landscape.

Over the years, factors like:

- inflation,

- rising healthcare costs,

- increased student loan debt,

- fluctuating housing markets

have impacted people's disposable income and the proportion of their income allocated to needs.

So, you may need to adjust these percentages based on your unique circumstances, but we'll delve into this further in step three.

Needs Bucket Section

Now onto step two: which is your spending for a month, so say in January.

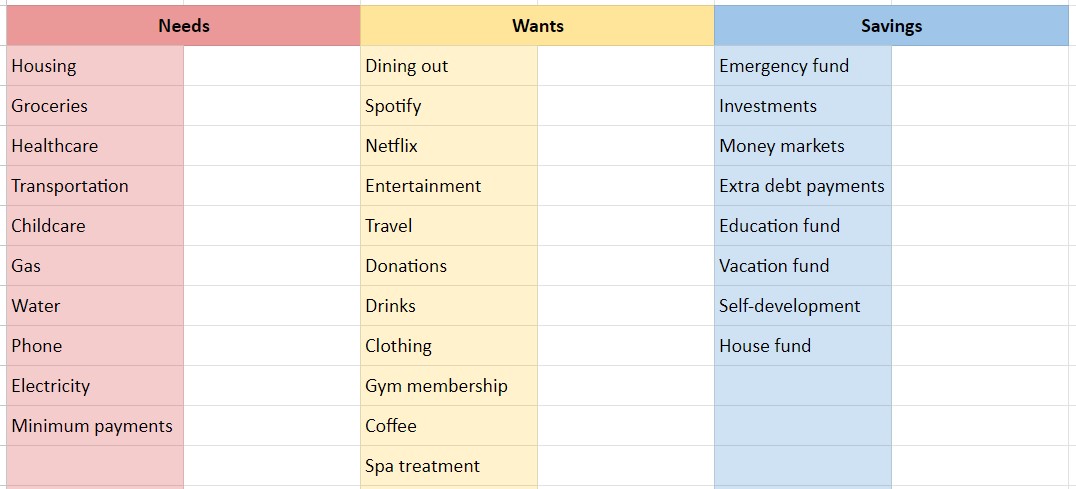

Start by filling in the three color-coded columns at the bottom for needs, wants, and savings.

Needs are the essentials—the non-negotiables—things like:

- housing (whether it be your rent or mortgage payments),

- your utilities (like water, gas, electricity),

- your transportation (which can be car payments or train tickets to go to work),

- your groceries,

- insurance,

- and minimum debt payments.

You'll find these amounts by reviewing your bank statements—debit card, credit card, or any apps you use.

Some apps may automatically categorize your spending, grouping all utilities into one, for example.

You can either enter one total amount or break it down by category like what I’ve done for gas, water, and electricity.

It depends on how detailed you want to be.

When it comes to spending on needs, aim to automate as much as possible.

Set up direct debits so bills are paid automatically.

The less friction, the better.

Constant reminders to pay bills, remembering your passwords and logging into systems, and manually transferring funds each month can make managing money feel like a chore and create unnecessary hassle.

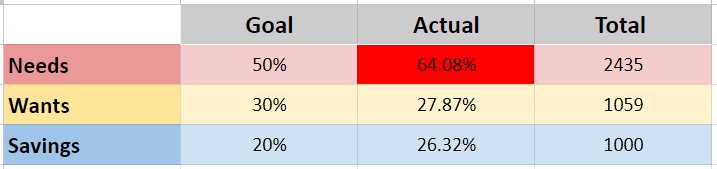

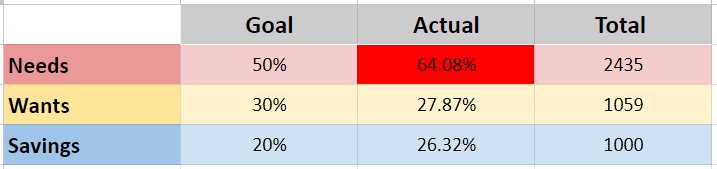

Once you've entered all the numbers, for example, $1,500 for housing, $300 for groceries, $80 for healthcare and you keep filling in the rest.

You can now check the table at the very top.

It immediately shows how you're doing relative to your goals.

As an example, I had set a target of 50% of my net income for needs, but this cell has turned red.

So clearly, I have exceeded the threshold, so then you would need to reassess that goal, which we'll address in step three.

Also, the column at the most right also displays the actual amount spent in your currency, providing both a percentage breakdown of your income spent on each category and the exact dollar/pound or whatever currency amount spent.

Wants Bucket Section

Moving on to the middle column—the wants bucket.

It's crucial to be clear with yourself here and define these categories upfront to prevent wants from creeping into needs just to justify spending.

Wants are non-essential items—completely optional.

Examples include:

- subscriptions like Netflix, Spotify, Amazon Prime,

- entertainment expenses such as going to the movies or dining out,

- indulgences like self-care treatments (nails, facials, haircuts),

- and travel.

The wants bucket also encompasses upgrade decisions, like:

- opting for a Mercedes over a more economical Toyota,

- choosing to shop at Marks and Spencers instead of Costco,

- or opting for a gym membership instead of working out at home.

These upgrades are little extras that enhance life and make it more enjoyable and entertaining.

Once you've filled in all the categories for your wants, as I've done here, the table at the top again indicates whether you're on track or need to cut back.

In my case, I'm spending 27% of my net income on wants, so the cell hasn't flagged up, meaning I have some leeway to spend more if I want.

Savings Bucket Section

Now, let's move on to the third column—the savings bucket.

This is all about prioritizing yourself first.

One effective method is setting up automatic transfers from your main bank account into a separate savings account as soon as you receive your paycheck.

By creating a system that works for you, you eliminate the need for willpower and remove any obstacles to saving.

This way, you don't reach the end of the month only to realize you don't have enough money left to save as you originally intended at the beginning of the month.

In this category, you can allocate funds for:

- investing in stocks,

- building up your emergency fund,

- contributing to various savings goals.

If you're unsure about where to start or the order in which to prioritize your savings, I have a helpful video titled “Optimal Order To Investing For Maximum Returns” that provides step-by-step guidance on where to put your money and in what order.

For your savings funds, I recommend having separate accounts for each major savings goal.

For instance, if you're saving for a house, create a dedicated house fund.

Similarly, if you're saving for a car, establish a car fund.

Having distinct accounts for each goal helps you track your progress more effectively and stay motivated.

It's far more encouraging than lumping all your savings into a single account.

The cell for the savings category operates in reverse.

If you're contributing less than your planned amount to the savings and investment bucket, the cell will turn red, indicating that you're not saving enough.

3 Questions To Ask Yourself

Now, onto step three, which is reviewing your progress—a crucial part of the process.

There's no use in setting ambitious goals and making plans if you don't follow through with them or take any action.

So, before your next payday, it's essential to review your spending using this tracker.

Here are the 3 main questions to ask yourself during this review:

Question #1

Have you paid all your bills on time, or were there any late payments?

If so, why?

Can you set up automatic payments to avoid this in the future?

Question #2

Are any of the cells showing up as red, indicating overspending or undersaving?

If so, why did this happen?

What did you spend on?

For instance, if you're overspending in the "wants" category, could you find ways to reduce costs without sacrificing too much enjoyment?

Or do you need to reevaluate your spending habits and cut back on certain expenses?

Conversely, if you spent less than anticipated in the "wants" category, consider increasing your contributions to savings and investments or paying off debt faster.

Question #3

If this is your first month using the tracker, keep in mind that the initial percentages may need adjustment to ensure long-term sustainability.

Instead of simply inputting the numbers and moving on, take the time to reflect at the end of the month and identify areas for improvement in your finances.

If you'd like to use the same tracker I'm using, it's available for free right here.

If you decide to try it out this month, I'd love to hear your feedback on how it worked for you.

Thanks for reading, and if you enjoyed this content, be sure to sign up for my newsletter to get the written version of investing and personal finance tips in your inbox!

Cheers!

- Ivan