BEFORE YOU READ

Get The Latest Issue Of The Vanilla Newsletter Sent Straight To Your Inbox

Join us every Sunday morning for a dose of investing wisdom and wealth-building insights while reading The Vanilla Newsletter.

Thank you for subscribing!

Have a great day!

THE VANILLA NEWSLETTER

Expand Your Knowledge Base

Deep dives on money, investing, personal finance, & wealth-building.

Optimal Order For Investing Your Money

According to a study by the Federal Reserve, if you have at least $400 saved to cover an unexpected emergency, you’re already financially better off than one third of Americans. It’s well known that most people do a poor job of managing their finances and there are seemingly few people that are responsible with their money. Having a good relationship with money doesn’t necessarily mean being ultra-wealthy or earning a high income, either. It just means that you are making financially sound choices, not making reckless decisions on a regular basis and are comfortable with your income and expenses.

Read Full Post

The Difference Between Trading and Investing

If I ask you about stock trading, you might think of the New York Stock Exchange. That’s where traders meet to buy and sell stocks, yelling out prices for their clients. But now, trading is different. Most of it happens online. Technology lets regular people trade from home, hoping to make money. Even though trading and investing both deal with stocks, they are not the same. Trading is when people buy and sell stocks quickly to make money. Investing is when people buy stocks and keep them for a long time, hoping they will grow in value. Some people do make a lot of money from trading, but it’s usually not a good idea for most people. We will talk about why.

Read Full Post

7 Biggest 401(k) Mistakes To Avoid

A 401(k) is a good way for families to save money. Many people start investing with their company's 401(k) plan because it’s easy and sometimes the company adds money to your account too. This is easier than opening a different account and picking investments by yourself. But just putting money into a 401(k) for many years doesn’t mean you’ll have enough for a comfy retirement. Surprisingly, most people only have a little over $88,000 in their 401(k), which isn’t enough. The AARP says you might need about $1.5 million to retire comfortably. So, why aren’t people saving more for their retirement? There’s more to getting ready for retirement than just signing up for a 401(k). Many people don’t know the best ways to save and invest for their future.

Read Full Post

How to Invest your Money (How ANYONE can be RICH)

It’s come to my attention that many people don't know how to invest to get wealthy enough to buy things like Lambos, and that's just not okay. What’s worse is that schools aren’t teaching these valuable skills—they focus more on subjects that you might not use every day like… Algebra 2. Even parents often prioritize homework over teaching financial literacy. But that’s another topic for another day.

Read Full Post

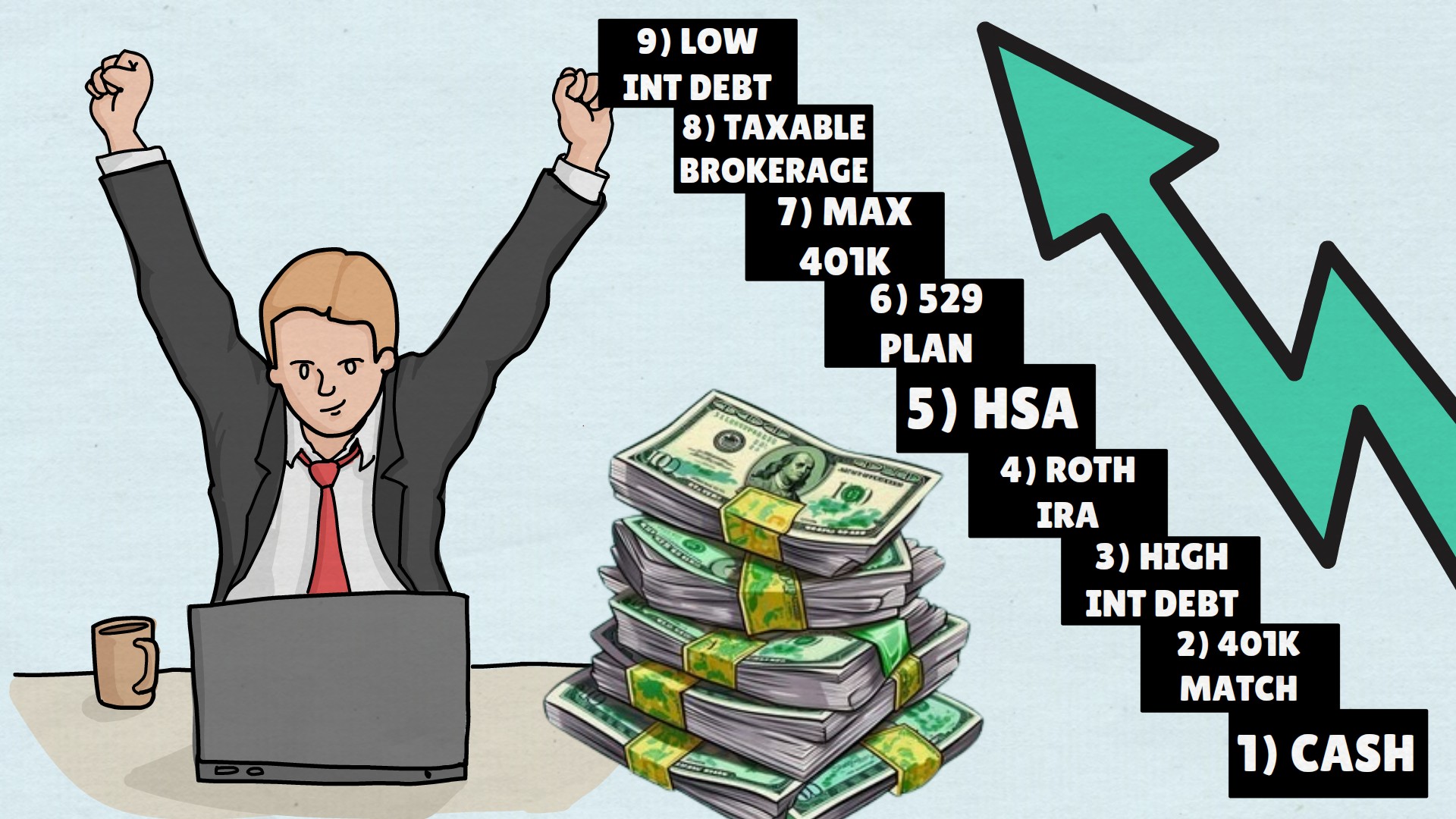

Ideal Order Of Investing For High Income Earners

When payday rolls around, you're swarmed with conflicting advice on how to allocate your hard-earned money. Should you pay off debt first? Or focus on saving? Or maybe dive straight into investing? It's natural to be scared of making the wrong choices, especially if you earn a high income. So, what's the optimal approach to go about it?

Read Full Post

How To Make Passive Income with $1000

Imagine the thrill of going to bed one night and waking up the next morning with a bit more money than you had before. It's incredibly enticing. When you're starting out, the amount doesn't matter much. The exhilaration of earning that first dollar passively is so addictive that you'll be driven to keep it going and watch it grow.

Read Full Post

How To Invest In Stocks For Beginners

When most individuals consider investing in the stock market, they often think about finding the next big thing, like the next Amazon. However, that's not the only approach to making money in stocks, and in reality, it's a strategy that often leads to losses. Many people lose money in the stock market because they are looking for the next hot stock without a solid long-term plan.

Read Full Post

Roth IRA: Become a Tax Free Millionaire With $12 a Day

So, I realized that saying you could become a millionaire completely tax-free by investing just $12 a day sounds completely far-fetched. But I promise you, if you read this article all the way through, give it a chance, it's all going to make complete sense.

Read Full Post

I Wish I Knew This Before I Started Investing

It's quite fascinating how many people discuss investing without demonstrating the practical steps. So, I'll swiftly guide you on six steps I wish I knew on how to invest in stocks when I first started.

Read Full PostGain A New Perspective

On Investing & Personal Finance

Join us every Sunday morning while reading The Vanilla Newsletter for a dose of investing wisdom and wealth-building insights.

Thank you for subscribing!

Have a great day!